Coca‑Cola Reports First Quarter 2022 Results

04-24-2022

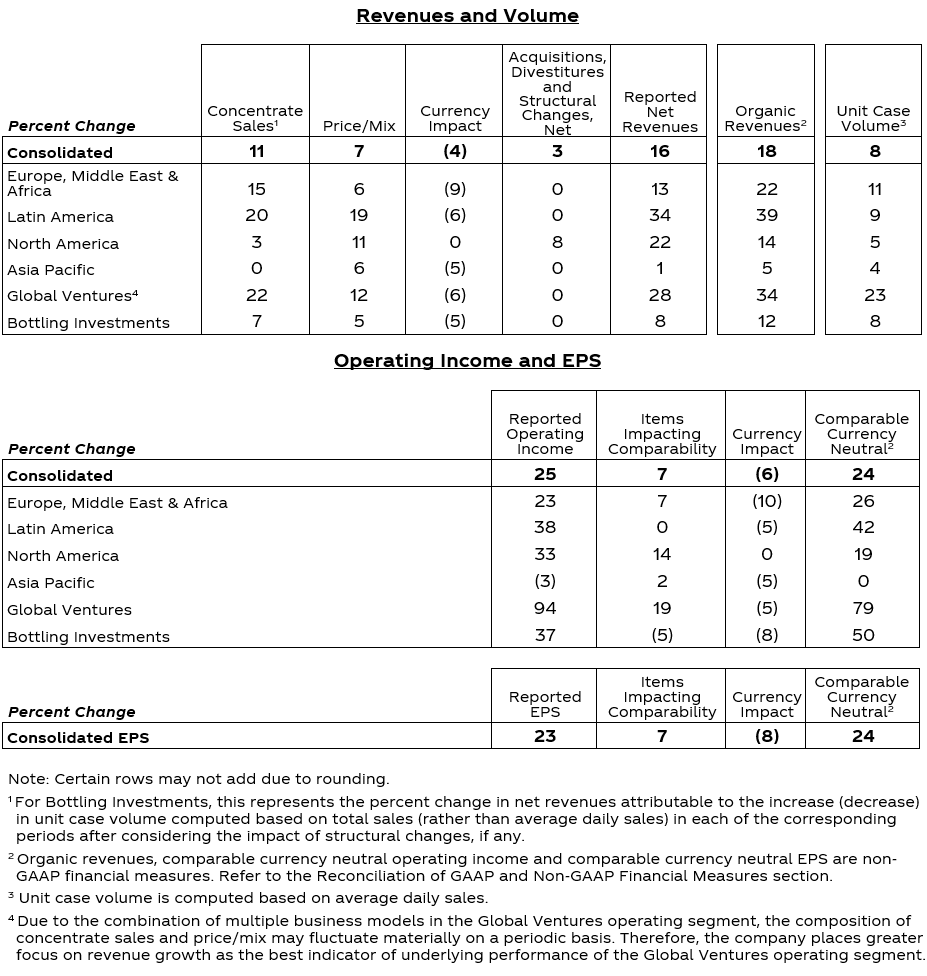

Global Unit Case Volume Grew 8%

Net Revenues Grew 16%;

Organic Revenues (Non-GAAP) Grew 18%

Operating Income Grew 25%;

Comparable Currency Neutral Operating Income (Non-GAAP) Grew 24%

Operating Margin Was 32.5% Versus 30.2% in the Prior Year;

Comparable Operating Margin (Non-GAAP) Was 31.4% Versus 31.0% in the Prior Year

EPS Grew 23% to $0.64; Comparable EPS (Non-GAAP) Grew 16% to $0.64

ATLANTA, April 25, 2022 – The Coca‑Cola Company today reported first quarter 2022 results, showing continued momentum in our marketplace performance. “We are pleased with our first quarter results as our company continues to execute effectively in a highly dynamic and uncertain operating environment,” said James Quincey, Chairman and CEO of The Coca‑Cola Company. “We remain true to our purpose and are staying close to consumers. We are confident in our full-year guidance, and we are well-equipped to win in all types of environments as we fuel strong topline momentum and create value for our stakeholders.”

Highlights

Quarterly / Full-Year Performance

- Revenues: Net revenues grew 16% to $10.5 billion, and organic revenues (non-GAAP) grew 18%. Revenue performance included 7% growth in price/mix and 11% growth in concentrate sales. Concentrate sales were 3 points ahead of unit case volume, largely due to the timing of concentrate shipments in the current quarter, partially offset by the impact of one less day in the quarter.

- Margin: Operating margin, which included items impacting comparability, was 32.5% versus 30.2% in the prior year, while comparable operating margin (non-GAAP) was 31.4% versus 31.0% in the prior year. Operating margin expansion was primarily driven by strong topline growth, partially offset by an increase in marketing investments versus the prior year, the impact of the BODYARMOR acquisition and currency headwinds.

- Earnings per share: EPS grew 23% to $0.64, and comparable EPS (non-GAAP) grew 16% to $0.64. Comparable EPS (non-GAAP) performance included the impact of an 8-point currency headwind.

- Market share: The company gained value share in total nonalcoholic ready-to-drink (NARTD) beverages, which included share gains in both at-home and away-from-home channels.

- Cash flow: Cash flow from operations was approximately $620 million, a decline of $1.0 billion versus the prior year, as strong business performance was more than offset by the impact of cycling the timing of working capital benefits in the prior year and higher 2021 annual incentives in the current year. Free cash flow (non-GAAP) was approximately $400 million, a decline of $1.0 billion versus the prior year.

Company Updates

- Support for employees and people in Ukraine: The company and its bottling partners continue to prioritize the safety of associates and their families in Ukraine. The company has activated relief funds to provide urgent financial assistance to all Ukraine-based system employees. To support humanitarian relief efforts in the region, the company, its global bottling partners and The Coca‑Cola Foundation have committed to contributions and product donations totaling nearly $15 million. This funding will support further relief efforts by the Red Cross and other organizations operating in Ukraine and neighboring countries, helping millions of displaced people.

- Driving beverage incidence through end-to-end consumer engagement: The company is continuing to leverage insights and passion points to improve its connection with existing and potential consumers. The company launched the “Magic Weekends” campaign for Trademark Coca‑Cola, which is the next chapter of the “Real Magic” platform. The company is partnering with food service aggregators across all nine of its operating units for this campaign, with a strong focus on Coca‑Cola Zero Sugar. The campaign, which is the largest “Coke and Meals” activation by the company planned for 2022, launched in the North America market with DoorDash as a delivery partner. Through this campaign, the company will optimize consumers’ digital purchasing experience by engaging with consumers at the point-of-sale, driving beverage incidence intended to create value for all stakeholders.

- Building a competitive edge through excellence in revenue growth management (RGM): The company, in close alignment with its bottling partners, continues to raise the bar in integrated execution to deliver value to its customers and consumers in an inflationary environment. Accelerated cost pressures and ongoing supply challenges continue across markets, and the company is leveraging RGM to provide compelling customer and consumer solutions by segmenting markets based on occasion, brand, price, package and channel. For example, in India, the company is increasing its consumer base by expanding affordable offerings at key transaction-driving price points through the use of single-serve packages. In the first quarter, this strategy yielded strong results with more than 500 million incremental transactions added in India, up nearly 20% versus the prior year. Approximately 70% of these incremental transactions were driven by small packages such as returnable glass bottles and affordable, single-serve PET packages.

- Partnering to make a difference and create shared value: The company continues to focus on issues that have a measurable, positive impact on communities as well as create opportunities for business growth. The company and its bottling partners are investing in various partnerships in order to expand the collection infrastructure and increase recycling in many markets, including Australia, Brazil, Japan and Mexico, while also expanding our reusable packaging portfolio. As part of a global partnership with the company, The Ocean Cleanup launched its trash collection system for testing in Vietnam. The system will intercept plastic debris in primary waterways before it can reach the ocean. Actions such as these help drive packaging circularity and support the company’s World Without Waste initiatives, including recyclability, virgin plastic reduction, reusable packaging and the company’s goal to collect and recycle a bottle or can for every one it sells by 2030.

Operating Review – Three Months Ended April 1, 2022

In addition to the data in the preceding tables, operating results included the following:

Consolidated

- Unit case volume grew 8%, with broad-based growth across all operating segments. Volume performance was driven by continued investments in the marketplace and a benefit from cycling the impact of the pandemic in the prior year. Developed markets as well as developing and emerging markets grew high single digits. Growth in developed markets was led by the United States, the United Kingdom and Mexico, while growth in developing and emerging markets was led by Brazil and India

Category performance was as follows:

- Sparkling soft drinks grew 7%, driven by growth across all geographic operating segments, primarily Europe, Middle East & Africa and Latin America. Trademark Coca‑Cola grew 6%, driven by growth across all geographic operating segments. Coca‑Cola® Zero Sugar grew 14%, driven by double-digit growth across all geographic operating segments. Sparkling flavors grew 7%, led by Europe, Middle East & Africa and Latin America.

- Nutrition, juice, dairy and plant-based beverages grew 12%, led by fairlife® in the United States, Minute Maid® Pulpy in China and Maaza® in India.

- Hydration, sports, coffee and tea grew 10%. Hydration grew 8%, led by strong growth in Latin America and Europe, Middle East & Africa. Sports drinks grew 22%, primarily driven by strong growth of BODYARMOR and Powerade®. Tea grew 8%, led by growth in Brazil, Japan and Mexico. Coffee grew 27%, primarily driven by cycling the impact of Costa retail store closures in the United Kingdom in the prior year and continued expansion of Costa coffee across markets.

- Price/mix grew 7%, driven by pricing actions in the marketplace along with favorable channel and package mix due to cycling the impact of the pandemic in the prior year. Price/mix further benefited by positive segment mix. Concentrate sales were 3 points ahead of unit case volume, largely due to the timing of concentrate shipments in the current quarter, partially offset by the impact of one less day in the quarter.

- Operating income grew 25%, which included items impacting comparability and a 6-point currency headwind. Comparable currency neutral operating income (non-GAAP) grew 24%, driven by strong organic revenue (non-GAAP) growth across all operating segments, including a benefit from the timing of concentrate shipments in certain operating segments. This was partially offset by an increase in marketing investments versus the prior year.

Europe, Middle East & Africa

- Unit case volume grew 11%, driven by investments in the marketplace and a benefit from cycling the impact of the pandemic in the prior year. Volume performance included strong growth in Western Europe, Egypt and Pakistan.

- Price/mix grew 6%, driven by pricing actions along with favorable channel and package mix due to cycling the impact of the pandemic in the prior year, in addition to inflationary pricing in Turkey. Concentrate sales were 4 points ahead of unit case volume, largely due to the timing of concentrate shipments in the current quarter, partially offset by the impact of one less day in the quarter.

- Operating income grew 23%, which included items impacting comparability and an 11-point currency headwind. Comparable currency neutral operating income (non-GAAP) grew 26%, primarily driven by strong organic revenue (non-GAAP) growth across all operating units, including a benefit from the timing of concentrate shipments in certain operating units. This was partially offset by an increase in marketing investments versus the prior year.

- The company gained value share in total NARTD beverages with share gains across most categories.

Latin America

- Unit case volume grew 9%, with strong growth across most categories. Growth was led by Mexico, Brazil, Argentina and Colombia.

- Price/mix grew 19%, driven by pricing actions in the marketplace and favorable channel and package mix, in addition to inflationary pricing in Argentina. Concentrate sales were 11 points ahead of unit case volume, largely due to the timing of concentrate shipments in the current quarter, partially offset by the impact of one less day in the quarter.

- Operating income grew 38%, which included a 7-point currency headwind. Comparable currency neutral operating income (non-GAAP) grew 42%, primarily driven by strong organic revenue (non-GAAP) growth, which included a benefit from the timing of concentrate shipments, partially offset by an increase in marketing investments versus the prior year.

- The company lost value share in total NARTD beverages as share gains in sparkling flavors, tea and coffee were more than offset by pressure in other categories.

North America

- Unit case volume grew 5%. Growth was driven by further recovery in the fountain business as coronavirus related uncertainty continued to abate. Sparkling soft drinks and sports drinks led growth during the quarter.

- Price/mix grew 11%, primarily driven by pricing actions in the marketplace, continued recovery in the fountain business and away-from-home channels, and strong growth in premium offerings. Price/mix growth included a benefit resulting from the timing of price increases in the prior year. Concentrate sales were 2 points behind unit case volume, primarily due to the impact of one less day in the quarter.

- Operating income grew 33%, which included items impacting comparability. Comparable currency neutral operating income (non-GAAP) grew 19%, driven by strong organic revenue (non-GAAP) growth, partially offset by an increase in marketing investments versus the prior year.

- The company gained value share in total NARTD beverages, driven by continued recovery in away-from-home channels along with strong performance in at-home channels across most categories.

Asia Pacific

- Unit case volume grew 4%, driven by India and the Philippines, partially offset by pressure in China due to reduced consumer mobility resulting from a resurgence in COVID-19 cases. Growth was led by Trademark Coca‑Cola and sparkling flavors.

- Price/mix grew 6%, driven by pricing actions in the marketplace, favorable channel and package mix, and positive geographic mix. Concentrate sales were 4 points behind unit case volume due to the timing of shipments in the current quarter along with the impact of one less day in the quarter.

- Operating income declined 3%, which included items impacting comparability and a 5-point currency headwind. Comparable currency neutral operating income (non-GAAP) was even, primarily driven by solid organic revenue (non-GAAP) growth, partially offset by an increase in marketing investments versus the prior year.

- The company gained value share in total NARTD beverages led by share gains in Japan, Australia and the Philippines.

Global Ventures

- Net revenues grew 28% and organic revenues (non-GAAP) grew 34%. Net revenues included a 6-point currency headwind. Revenue growth benefited from cycling the impact of Costa retail store closures in the United Kingdom in the prior year.

- Operating income growth and comparable currency neutral operating income (non-GAAP) growth were driven by strong organic revenue (non-GAAP) growth.

Bottling Investments

- Unit case volume grew 8%, driven by strong growth in the key markets of India and the Philippines.

- Price/mix grew 5%, driven by pricing actions across key markets.

- Operating income grew 37%, which included items impacting comparability and a 7-point headwind from currency. Comparable currency neutral operating income (non-GAAP) grew 50%, driven by strong organic revenue (non-GAAP) growth.

Outlook

The 2022 outlook information provided below includes forward-looking non-GAAP financial measures, which management uses in measuring performance. The company is not able to reconcile full-year 2022 projected organic revenues (non-GAAP) to full-year 2022 projected reported net revenues, full-year 2022 projected comparable net revenues (non-GAAP) to full-year 2022 projected reported net revenues, full-year 2022 projected comparable cost of goods sold (non-GAAP) to full-year 2022 projected reported cost of goods sold, full-year 2022 projected underlying effective tax rate (non-GAAP) to full-year 2022 projected reported effective tax rate, full-year 2022 projected comparable currency neutral EPS (non-GAAP) to full-year 2022 projected reported EPS or full-year 2022 projected comparable EPS (non-GAAP) to full-year 2022 projected reported EPS without unreasonable efforts because it is not possible to predict with a reasonable degree of certainty the actual impact of changes in foreign currency exchange rates throughout 2022; the exact timing and amount of acquisitions, divestitures and/or structural changes throughout 2022; the exact timing and amount of items impacting comparability throughout 2022; and the actual impact of changes in commodity costs throughout 2022. The unavailable information could have a significant impact on the company’s full-year 2022 reported financial results.

Quarterly Performance

On March 8, 2022, the company announced the suspension of its business in Russia as a result of the conflict in Ukraine. The approximate direct impacts of this are estimated to be as follows:

- 1% impact to unit case volume

- 1% to 2% impact to net revenues and operating income

- $0.04 impact to comparable EPS (non-GAAP)

These estimated impacts are reflected in the outlook commentary below.

The company expects to deliver organic revenue (non-GAAP) growth of 7% to 8%. – No Change

For comparable net revenues (non-GAAP), the company expects a 2% to 3% currency headwind based on the current rates and including the impact of hedged positions, in addition to a 3% tailwind from acquisitions. – No Change

The company expects commodity price inflation to be a mid single-digit percentage headwind on comparable cost of goods sold (non-GAAP), based on the current rates and including the impact of hedged positions. – No Change

The company’s underlying effective tax rate (non-GAAP) is estimated to be 19.5%. This does not include the impact of ongoing tax litigation with the U.S. Internal Revenue Service, if the company were not to prevail. – Updated

Given the above considerations, the company expects to deliver comparable currency neutral EPS (non-GAAP) growth of 8% to 10% and comparable EPS (non-GAAP) growth of 5% to 6%, versus $2.32 in 2021. – No Change

Comparable EPS (non-GAAP) percentage growth is expected to include a 3% to 4% currency headwind based on the current rates and including the impact of hedged positions, in addition to a minimal tailwind from acquisitions. – No Change

The company expects to generate free cash flow (non-GAAP) of approximately $10.5 billion through cash flow from operations of approximately $12.0 billion, less capital expenditures of approximately $1.5 billion. This does not include any potential payments related to ongoing tax litigation with the U.S. Internal Revenue Service. – No Change

Second Quarter 2022 Considerations – New

Comparable net revenues (non-GAAP) are expected to include an approximate 4% currency headwind based on the current rates and including the impact of hedged positions, in addition to a 3% tailwind from acquisitions.

Comparable EPS (non-GAAP) percentage growth is expected to include an approximate 4% currency headwind based on the current rates and including the impact of hedged positions.

Notes

- All references to growth rate percentages and share compare the results of the period to those of the prior year comparable period, unless otherwise noted.

- All references to volume and volume percentage changes indicate unit case volume, unless otherwise noted. All volume percentage changes are computed based on average daily sales, unless otherwise noted. “Unit case” means a unit of measurement equal to 192 U.S. fluid ounces of finished beverage (24 eight-ounce servings), with the exception of unit case equivalents for Costa non-ready-to-drink beverage products which are primarily measured in number of transactions. “Unit case volume” means the number of unit cases (or unit case equivalents) of company beverages directly or indirectly sold by the company and its bottling partners to customers or consumers.

- “Concentrate sales” represents the amount of concentrates, syrups, beverage bases, source waters and powders/minerals (in all instances expressed in unit case equivalents) sold by, or used in finished beverages sold by, the company to its bottling partners or other customers. For Costa non-ready-to-drink beverage products, “concentrate sales” represents the amount of beverages, primarily measured in number of transactions (in all instances expressed in unit case equivalents) sold by the company to customers or consumers. In the reconciliation of reported net revenues, “concentrate sales” represents the percent change in net revenues attributable to the increase (decrease) in concentrate sales volume for the geographic operating segments and the Global Ventures operating segment after considering the impact of structural changes, if any. For the Bottling Investments operating segment, this represents the percent change in net revenues attributable to the increase (decrease) in unit case volume computed based on total sales (rather than average daily sales) in each of the corresponding periods after considering the impact of structural changes, if any. The Bottling Investments operating segment reflects unit case volume growth for consolidated bottlers only.

- “Price/mix” represents the change in net operating revenues caused by factors such as price changes, the mix of products and packages sold, and the mix of channels and geographic territories where the sales occurred.

- First quarter 2022 financial results were impacted by one less day as compared to first quarter 2021, and fourth quarter 2022 financial results will be impacted by one additional day as compared to fourth quarter 2021. Unit case volume results for the quarters are not impacted by the variances in days due to the average daily sales computation referenced above.

Conference Call

The company is hosting a conference call with investors and analysts to discuss first quarter 2022 operating results today, April 25, 2022, at 8:30 a.m. ET. The company invites participants to listen to a live webcast of the conference call on the company’s website, http://www.coca-colacompany.com, in the “Investors” section. An audio replay in downloadable digital format and a transcript of the call will be available on the website within 24 hours following the call. Further, the “Investors” section of the website includes certain supplemental information and a reconciliation of non-GAAP financial measures to the company’s results as reported under GAAP, which may be used during the call when discussing financial results.

Forward-Looking Statements

This press release may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause The Coca‑Cola Company’s actual results to differ materially from its historical experience and our present expectations or projections. These risks include, but are not limited to, the negative impacts of, and continuing uncertainties associated with the scope, severity and duration of the global COVID-19 pandemic and any resurgences of the pandemic, including the number of people contracting the virus, the impact of shelter-in-place and social distancing requirements, the impact of governmental actions across the globe to contain the virus, vaccine availability, rates of vaccination, the effectiveness of vaccines against existing and new variants of the virus, governmental or other vaccine mandates and potential associated business and supply chain disruptions, and the substance and pace of the post-pandemic economic recovery; an inability to realize the economic benefits from our productivity initiatives, including our reorganization and related strategic realignment initiatives; an inability to attract or retain a highly skilled and diverse workforce; increased competition; an inability to renew collective bargaining agreements on satisfactory terms, or we or our bottling partners experience strikes, work stoppages, labor shortages or labor unrest; an inability to be successful in our innovation activities; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging and developing markets; increased cost, disruption of supply or shortage of energy or fuel; inflationary pressures; increased cost, disruption of supply or shortage of ingredients, other raw materials, packaging materials, aluminum cans and other containers; an inability to successfully manage new product launches; obesity and other health-related concerns; evolving consumer product and shopping preferences; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non-nutritive sweeteners and biotechnology-derived substances, and of other substances present in our beverage products or packaging materials; damage to our brand image, corporate reputation and social license to operate from negative publicity, whether or not warranted, concerning product safety or quality, workplace and human rights, obesity or other issues; an inability to maintain good relationships with our bottling partners; deterioration in our bottling partners’ financial condition; an inability to successfully integrate and manage consolidated bottling operations or other acquired businesses or brands; an inability to successfully manage our refranchising activities; increases in income tax rates, changes in income tax laws or the unfavorable resolution of tax matters, including the outcome of our ongoing tax dispute or any related disputes with the U.S. Internal Revenue Service (“IRS”); the possibility that the assumptions used to calculate our estimated aggregate incremental tax and interest liability related to the potential unfavorable outcome of the ongoing tax dispute with the IRS could significantly change; increased or new indirect taxes in the United States and throughout the world; changes in laws and regulations relating to beverage containers and packaging; significant additional labeling or warning requirements or limitations on the marketing or sale of our products; litigation or legal proceedings; conducting business in markets with high-risk legal compliance environments; failure to adequately protect, or disputes relating to, trademarks, formulae and other intellectual property rights; changes in, or failure to comply with, the laws and regulations applicable to our products or our business operations; fluctuations in foreign currency exchange rates; interest rate increases; unfavorable general economic conditions in the United States and international markets; an inability to achieve our overall long-term growth objectives; default by or failure of one or more of our counterparty financial institutions; impairment charges; failure to realize a significant portion of the anticipated benefits of our strategic relationship with Monster Beverage Corporation; an inability to protect our information systems against service interruption, misappropriation of data or breaches of security; failure to comply with personal data protection and privacy laws; failure to digitize the Coca‑Cola system; failure by our third-party service providers and business partners to satisfactorily fulfill their commitments and responsibilities; failure to achieve ESG goals and accurately report our progress due to operational, financial, legal, and other risks, many of which are outside our control, and are dependent on the actions of our bottling partners and other third parties; increasing concerns about the environmental impact of plastic bottles and other packaging materials; water scarcity and poor quality; increased demand for food products and decreased agricultural productivity; climate change and legal or regulatory responses thereto; adverse weather conditions; and other risks discussed in our filings with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2020 and our subsequently filed Quarterly Reports on Form 10-Q, which filings are available from the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements.